November 2020 marks the 10th anniversary of Financial Literacy Month in Canada. Who could have imagined a decade ago the unprecedented financial upheaval we would be facing in 2020? Now, more than ever, knowing what Financial Freedom means and understanding our finances is crucial.

Money is said to be one of the biggest stressors in life, and we know that stress can greatly affect our health. A healthy financial position means freedom. Freedom to make choices based on our values and priorities rather than being forced to make decisions to service debt or obligations.

When we make decisions that are not aligned with our values, we know it negatively impacts our happiness. Taking care of our finances by planning and living within our means can greatly improve both our health and happiness as we navigate these uncertain times.

Let’s take a look at Canadians

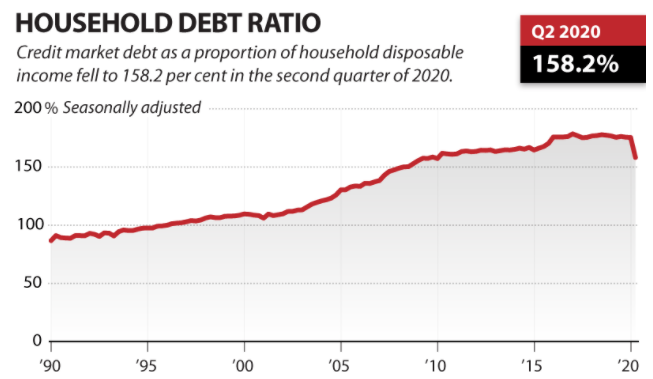

Almost 50% of Canadians live paycheque to paycheque and most households feel economic stress regardless of their income bracket. Before March 2020, Canadian consumer debt was at 177%, which means for every $1 of income earned, households owed $1.77 in debt.

The shutdown that happened in March 2020 was devastating to most; job layoffs, small businesses shuttered, closure of manufacturing, government and retail establishments. It impacted everyone. Despite all this carnage, there was a silver lining – between April and June, the Canadian consumer debt dropped significantly to 158%!

It seems with the closure of everything and the uncertainty that loomed, households stopped unnecessary spending. We saved money by eating at home, not commuting, or impulse shopping. We simply learned to live with less!

Most people are still being very cautious about their spending. Banks, financial institutions & government agencies are offering help through special programs to help people recover. Depending on location, we still face limitations on travel, dining-out and extra-curricular activities.

Let us use this time to re-evaluate our financial priorities and start focusing on creating our path to personal financial freedom.

Where to Start

Much like we teach in our Success By Design program, we need to understand where we are right now in relation to where we want to be.

These 3 steps are a great place to start:

1. Assess the gap between our income vs. spending. In other words, Spend LESS than we make.

2. Quantify our debt, In other words, Know how much we owe and avoid adding more.

3. Identify what financial freedom looks like. So, ask yourself, What are our end-state financial goals?

With this information, we can start putting an action plan together to move closer to our financial freedom.

If 2020 has taught us anything…it is that life is unpredictable, carving out time to focus on our financial wellness, maintaining mindful spending and working on a plan to live within our means, can bring us serenity and security in these crazy times.

“A good financial plan is a road map that shows us exactly how the choices we make today will affect our future.”

Alexa Von Tobel

Recent Comments